Saturday, January 29, 2022

Friday, January 28, 2022

Supply and Demand for Space Travel

Growing up seeing the NASA Apollo missions, it was easy for me to believe that I would see rockets flying all over the solar system. Despite the triumphs of the Shuttle, ISS, and Mars rovers, the next 40 years did not quite live up to expectations. But the last 10 did. For forty years, the costs barely budged but they have fallen one hundredfold since 2010! See this cool info-graphic on truly revolutionary changes in costs.

Thursday, January 27, 2022

Can ESG investing stop climate change without sacrificing returns?

The WSJ gives us a clear answer: NO.

Although this is a gross simplification of the argument, ESG investing to save the environment means buying fossil reserves and leaving them in the ground where they lose all their market value.

The ESG paradox: "if you don't lose money on ESG investing [relative to non-ESG investing], ESG investing doesn't work. Take your pick."

Tuesday, January 25, 2022

Venture Capital, Innovation, and Mark Andreessen

“In venture capital, you think a lot about so-called adverse selection,” Mr. Andreessen says. “ ‘Why am I so lucky as to be the person you’re trying to raise money from?’ You want to get to positive selection, the best people coming to you.”

...

“Super-talented” people, Mr. Andreessen figures, leave academia or big companies because they realize they’re “swimming in an ocean of mediocrity.” Hence the positive selection for venture capitalists.

Here's why:

Mr. Andreessen starts with the replication crisis in scientific studies, especially in psychology—over half of studies can’t be replicated. I suggest “studies show” are the two most dangerous words in the English language.

HT: Quinn

Wednesday, January 19, 2022

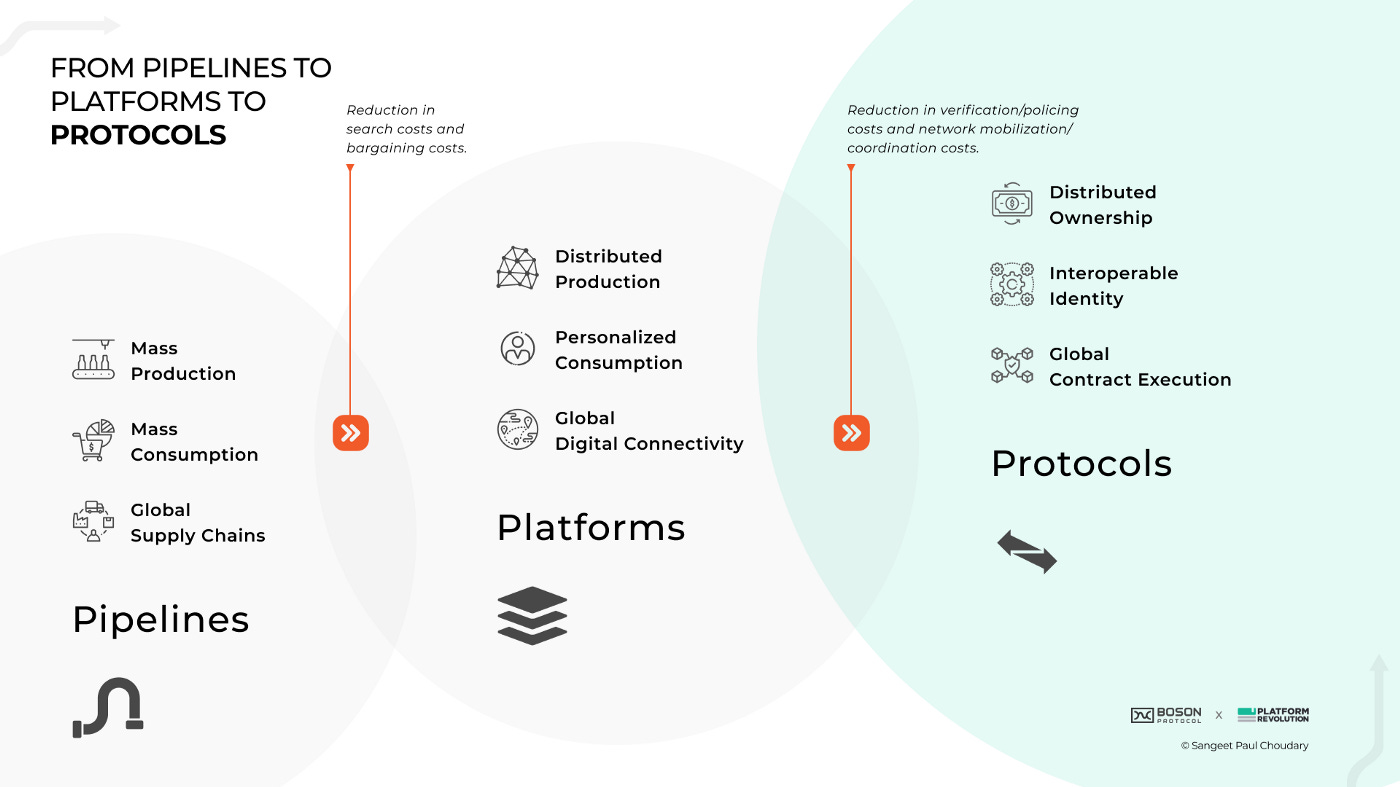

Pipelines --> Platforms --> Protocols

Interesting article about how market institutions are changing with blockchain technology:

- Platforms drove market efficiencies by leveraging data to reduce search costs and verification costs. This involved an inherent trade-off as market participants — particularly consumers — needed to surrender their data to the platform to benefit from these market efficiencies.

- This surrender of data and attendant lock-in increased the risks of privacy invasion, loss of agency through over-dependance, and unilateral censorship as centralized platforms could change their policies at will.

- With protocols, property rights go back to the creator and identity goes back to the consumer.

Double Marginalization Distortions

Double Marginalization occurs when two firms within a supply chain "compete" for the value the chain creates. The upstream firm's margin becomes part of the marginal cost incurred downstream which then gets magnified by the downstream firm setting its margin. Prices are too high, output is too low, and further investment is less profitable. If the firms were to integrate, they would "marginalize" only once, leading to increases in consumer surplus and profits to all parties.

An analogous effect occurs when a turnover tax becomes a value added tax (VAT). A turnover tax, or sales tax, is a margin on all firms within a supply chain while a VAT represents a single margin. Firms in a supply chain tend to merge simply to avoid multiple turnover taxes. In "How Distortive are Turnover Taxes? Evidence from Replacing Turnover Tax with VAT," Xing, Bilicka and Hou investigate what happened in China when taxation transitioned from a turnover tax to a VAT. Without the motive to avoid double marginalization, firms can now outsource more if outsourcing is more efficient. As predicted:

The reform increased sales, R&D investment, and employment for affected service firms, which is primarily driven by outsourcing from downstream manufacturing firms. We document that smaller and less innovative manufacturing firms outsource more, and reallocation increases the quality of innovation for affected service firms.

Saturday, January 15, 2022

Why are Google, Amazon, Meta and Micrsoft laying their own transatlantic cables?

The ability of these companies to vertically integrate all the way down to the level of the physical infrastructure of the internet itself reduces their cost for delivering everything from Google Search and Facebook’s social networking services to Amazon and Microsoft’s cloud services. It also widens the moat between themselves and any potential competitors.

Thursday, January 6, 2022

Why is St. Louis considering restarting a trolley that no one wants?

Maxim: Consider all costs and benefits that vary with the consequence of a decision [if you miss some that is the hidden-cost fallacy]; but only costs and benefits that vary with the consequence of a decision [if you consider irrelevant ones that is the sunk-cost fallacy].

- 2018: The trolley started operational life —six years behind schedule and about $10 million over budget. Ticket revenue was 10% of what was originally forecast and nearbt businesses hated it.

- 2019: St Lous shut it down, but the Federal Transit Administration (FTA) demanded the return of $37 million the government paid for the project.

Sunday, January 2, 2022

The last refuge of a vacant liberal mind

On Christmas day, the headline in the NY Times business section was As Prices Rise, Biden Turns to Antitrust Enforcers. Larry Summers immediately [and correctly] bashed the idea:

“The emerging claim that antitrust can combat inflation reflects ‘science denial,’ ” tweeted Harvard economist Lawrence Summers, a senior official in the Obama and Clinton administrations. “There are many areas like transitory inflation where serious economists differ. Antitrust as an anti-inflation strategy is not one of them.”

In the late 1970's, I heard John Kenneth Galbraith, the economist in charge of price controls during WWII, say much the same. He called the idea "the last refuge of a vacant liberal mind." The turn of phrase was so elegant and shocking--at the time, I was a liberal--it has stayed with me.