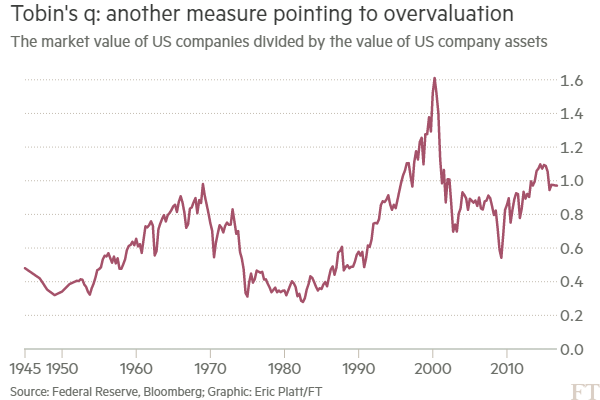

FT has a nice summary, with graphs.

Tuesday, February 28, 2017

Learning Curves in F-35 Production

This CNBC report on Lockheed-Martin plant producing the F-35 reports on the declining cost per fighter over time. The two sources are cost savings from increased automation and from learning curves. The more you buy the more you save.

Hat tip: Helen Gorman

Hat tip: Helen Gorman

Monday, February 27, 2017

Trump was right: China ate America's manufacturing jobs.

Freakonomics podcast featuring labor economist David Autor:

- Between 1991 and 2013, Chinese exports grew from roughly 2 percent of the world’s total to nearly 20 percent.

- ...There are two big differences of the last two decades relative to earlier periods. One is that a lot of our trade prior to China’s rise, a lot of it was North-North trade. You know, trading between wealthy nations. So you know, we sell aircraft engines to France and we buy cheese and wine and Renaults or maybe we buy Mercedes from Germany. And so it’s a lot of high-skill people trading high-skill goods and we’re trading on the basis of taste. Like, “I like your vehicles. You like my aircraft.” It’s not trying to see who can make the cheapest version of X, Y, or Z. We’re often focusing on a set of expensive goods in which we all are differently good at different subsets.

- So when the United States trades with the developing world, we’re going to typically export skill-intensive products: aircraft engines, electronics, movies, and TV programs and things that use a lot of highly educated labor. And we’re going to tend to import low-skilled or what we call labor-intensive products like you know footwear and textiles, leather goods, things that require a lot of hand assembly.

- TRADE BENEFITS US SKILLED WORKERS AND CONSUMERS: And so what does that do? Well, when we export those high skill-intensive goods we’re basically raising demand for skilled or educated workers in the United States. When we import those labor-intensive goods, we’re going to reduce demand for blue-collar workers, who are not doing skill-intensive production. Now we benefit because we get lower prices on the goods we consume and we sell the things that we’re good at making at a higher price to the world. So that raises GDP but simultaneously it tends to make high-skilled and highly educated labor better off, raise their wages, and it tends to make low-skilled manually intensive laborers worse off because there is less demand for their services – so there’s going to be fewer of them employed or they’re going to be employed at lower wages. So the net effect you can show analytically is going to be positive.

- BUT HARMS U.S. UNSKILLED LABOR: But the redistributional consequences are, many of us would view that as adverse because we would rather redistribute from rich to poor than poor to rich. And trade is kind of working in the redistributing from poor to rich direction in the United States. The scale of benefits and harms are rather incommensurate. So for individuals, you know, I have less expensive consumer items because of imports from China. But it hasn’t affected my employment or my wages. For many others – on the order of at least a million U.S. manufacturing workers – it meant the end of their jobs and in many cases the end of their industries.

BOTTOM LINE: Trade helped U.S. skilled workers (by increasing demand for their services) and consumers (by giving consumers cheaper goods), but hurt U.S. unskilled workers (by reducing demand for their services). In a frictionless world, they would move to their next best alternative (e.g., Texas or Tennessee), but instead they are moved out of the labor force and into the safety net (e.g., medicare, medicaid, early retirement, disability insurance, food stamps, and TANF).

Interesting closing thoughts by David Autor, which seems to echo President Trump's campaign:

I think the other thing that we have to recognize, and that economists have tended not to emphasize is that jobs aren’t purely income. They are part of identity. They structure people’s lives. They give them a purpose and a social community and a sense of relevance in the world. And I think that is a lot of the frustration that we see in manufacturing-intensive areas. We saw a lot of that actually in the recent election. People feel like their place in the universe, or at least in the economy, has really been kind of reduced, made less valuable. And I think that that’s costly even beyond the direct financial costs.

Thursday, February 23, 2017

Hotel mergers increase output

Recent article by some middling economists who show that following mergers among hotels, occupancy goes up. They identify two theoretical mechanisms that could explain the result:

- The first is that mergers reduce uncertainty about demand. Less uncertainty means better forecasts, which means fewer pricing errors—and higher occupancy—as the hotels are better able to match realized demand to available capacity.

- A second mechanism—that the merged hotels are better able to compete for group and convention business—could also account for price and/or quantity increases. If the merged hotels are large enough to host groups, but the premerger hotels are not, then the merger could increase convention demand for the merged hotels. However, our finding that occupancy increases only in markets with high levels of uncertainty and capacity utilization leads us to prefer the former explanation, although we cannot rule out the possibility that increases in group demand, particularly during low-demand periods, could account for the results.

Thursday links: taxes, Keynesian stimulus, and the super rich

Former student John Tamny has a critique of Keynesian Economics with reference to the Rio Olympics.

The Boston Globe takes on the zero-sum fallacy by essentially praising inequality:

To begin with, all eight men earned their extraordinary wealth. Through ingenuity, talent, and immense effort, they created enterprises that provide hundreds of millions, even billions, of human beings with goods and services that make life better, healthier, safer, and more affordable.

Moreover, the Oxfam Eight didn’t grow their fortunes by preventing other people from growing theirs. Their wealth may equal that of half the people on Earth (though Oxfam’s methodology is dubious), but the world’s poor have been climbing out of poverty at the fastest rate in human history. Byanyima rightly bewails the fact that “1 in 10 people survive on less than $2 a day” — what she omits is that over the past 30 years, the number of people living in such extreme poverty has fallen by nearly 75 percent. Johan Norberg, writing in Spiked Review, provides hard numbers: Worldwide, an average of 138,000 people climb out of extreme poverty every day. Since 1990, the world’s population has grown by more than 2 billion, yet the ranks of those in extreme poverty has shrunk by more than 1.25 billion.

Wednesday, February 22, 2017

Is Amazon's growth anticompetitive?

Amazon's focus on growing market share with low prices has benefited consumers but given it a big share of the online market.

- In 2013, it sold more than its next twelve online competitors combined.

- By some estimates, Amazon now captures 46% of online shopping

- In addition to being a retailer, it is a marketing platform, a delivery and logistics network, a payment service, a credit lender, an auction house, a major book publisher, a producer of television and films, a fashion designer, a hardware manufacturer, and a leading provider of cloud server space and computing power.

- Although Amazon has clocked staggering growth—reporting double-digit increases in net sales yearly—it reports meager profits, choosing to invest aggressively instead.

- The company listed consistent losses for the first seven years it was in business, with debts of $2 billion. ...ts highest yearly net income was still less than 1% of its net sales.

- Despite the company’s history of thin returns, investors have zealously backed it: Amazon’s shares trade at over 900 times diluted earnings, making it the most expensive stock in the Standard & Poor’s 500

- ...critics often fumble to explain how a company that has so clearly delivered enormous benefits to consumers—not to mention revolutionized e-commerce in general—could, at the end of the day, threaten our markets. Trying to make sense of the contradiction, one journalist noted that the critics’ argument seems to be that “even though Amazon’s activities tend to reduce book prices, which is considered good for consumers, they ultimately hurt consumers.”

The linked article tries to make a case that the antitrust authorities should intervene now, but they it not address an obvious solution, if Amazon starts behaving anticompetitively, the antitrust authorities can act when it does.

HT: Quinn

HT: Quinn

How to keep diplomats from defecting to the West

This appears to be a problem for North Korea. The solution to this pesky moral hazard problem is to force diplomats to "post a bond" in the form of offerring a hostage.

Thae said there was one big obstacle to his defection.

Thae Yong-ho: All North Korean diplomats are forced to leave one of their children back in Pyongyang as a hostage.

Bill Whitaker: As a hostage?

Thae Yong-ho: Yes.

His break came when that policy unexpectedly changed and Thae’s oldest son was allowed to join the family in London. They all agreed to defect. He would not give us the details about his escape and who helped. But we know he was kept in a safe house by South Korean intelligence agents and questioned for more than three months. He said it was too dangerous for us to meet his family.

But if you are going to do it, you must do it continuously.

This is not unlike an alleged criminal posting a bond while awaiting trial or a tradesman posting a bond against faulty repairs.

Suggested by Helen Gorman

Monday, February 13, 2017

Who monitors the monitors?

In our problem solving framework we ask three simple questions to diagnose goal misalignment:

The economist has an article on the history of this problem:

To spoil the ending, the solution is always "it depends."

- Q1: Who made the bad decision?

- Q2: Did they have enough information to make a good decision?

- Q3: And the incentive to do so?

- S1: Let someone else make the decision, someone with better information or better incentives.

- S2: Give more information to the current decision-maker.

- S3: Change the incentives of the current decision-maker.

The economist has an article on the history of this problem:

In business and finance, this is known as the “principal-agent” problem. Shareholders employ managers to run a company; investors use fund managers to look after their savings. That makes sense. It allows us to take advantage of the expertise of others, and of economies of scale in fund management (it costs little more to look after $10m than $1m). But it is extremely hard to align the interests of principals and agents exactly.

To spoil the ending, the solution is always "it depends."

Saturday, February 11, 2017

Cost disease in education and health

Fabulous post on why costs have gone up so much in education and healthcare without a corresponding increase in education or health.

The two graphs describe the problem:

The question an economist would ask is simple:

So, imagine you’re a poor person. White, minority, whatever. Which would you prefer?

- a. Sending your child to a 2016 school?

- b. Or sending your child to a 1975 school, and getting a check for $5,000 every year?

We ask the same question:

Do you think the average poor or middle-class person would rather:

- a) Get modern health care

- b) Get the same amount of health care as their parents’ generation, but with modern technology like ACE inhibitors, and also earn $8000 extra a year

Thursday, February 9, 2017

Why three point shots are the best in basketball

Basketball coach Dan D'Antoni uses expected value per attempt to explain why his team takes so many 3-point shots:

HT: Jason

"If you can get a layup and it's clean — it's not one that's highly contested — it's [worth] 1.8 points [per attempt]. It's 1.3 from that corner, 1.27. Do you know what a post-up is, with a guy standing over top of you? It's 0.78. So you run your team down there and we'll see how long you can stay with teams that can play the other way. You've seen it in the NBA. The last two championships have been Cleveland and Golden State. What do they do? You don't see anybody post up. They just spread that thing out and go."

HT: Jason

Tuesday, February 7, 2017

The trickiest trade in the world is ...

negotiating a ransom. Watch Bloomberg podcast to see how reputation trumps uncertainty, moral hazard, and adverse selection.

HT: Merle Hazard

HT: Merle Hazard

Thursday, February 2, 2017

Another pension fund lowers discount rate to 7%

If a pension fund has to pay out $100 in 30 years, and earns 7.5% on its investments, it must save 100/(1.075)^30=13.14 today. If it earns only 7.0%, the amount that it much save increases by 15%.

Calstrs, the second biggest pension fund in the world, just admitted that it is reducing its target rate of return (also its discount rate) from 7.5% to 7.0%. The increase in savings is split between the teachers and the State of California, the employer of the teachers.

Calstrs, the second biggest pension fund in the world, just admitted that it is reducing its target rate of return (also its discount rate) from 7.5% to 7.0%. The increase in savings is split between the teachers and the State of California, the employer of the teachers.

Approximately 80,000 current members of Calstrs could see an increase in their yearly pension contributions of $200 or more as a result of Thursday’s move, Calstrs said. The state of California has already budgeted an extra $153 million for its pension contribution to cover the rate change, bringing the total contribution to $2.8 billion.

Subscribe to:

Posts (Atom)