https://www.youtube.com/watch?v=wOFPggYsKfc

Managerial Econ

Economic Analysis of Business Practice

Tuesday, June 24, 2025

Middling professor opines on deregulation, wealth creation, benefit-cost analysis

Saturday, June 21, 2025

Anchor Shock Pricing: How Vail makes most of its money

In 2008, 65% of skiers at Vail Resorts bought single-day lift tickets. Today, 75% of their customers purchase season passes, committing thousands of dollars months before the first snowfall.

People are shocked by the $329 daily ticket price and then realize that “If I ski just 3-4 days this season, the annual pass pays for itself!”

In other words, Vail "anchors" price expectations at $329, and then offers consumers dramatically lower average daily prices with the annual pass, and they switch.

This is akin to bundling as a form of indirect price discrimination but includes a bit of psychology.

CITE: DemandCurve.com

HT: Justin

Wednesday, June 18, 2025

PolyMarket.com predicts outcomes of Israel-Iran conflict

Probability Event

66% US Military action against Iran by July?

59% Khameni out as Supreme Leader of Iran by 2025?

59% Fordow nuclear facility destroyed before July?

--------UPDATED Jun 18, 2025 (link)---------

Saturday, June 14, 2025

Weaker incentives in unionized plants make them more likely to close

Unionized plants have worse incentive alignment:

- 26% less likely to offer performance-based bonuses.

- 11% less likely to promote based on performance

- 13% less likely to dismiss workers for poor performance.

- Higher rates of business closures,

- lower investment

- slower employment growth

BOTTOM LINE: right-to-work states (no unions) have higher employment and better outcomes.

CITE:Maksimovic, Vojislav and Yang, Liu A., What do Unions do? Incentives and Investments (June 16, 2023). Available at SSRN: https://ssrn.com/abstract=4565288 or http://dx.doi.org/10.2139/ssrn.4565288

Thursday, June 12, 2025

Monday, June 9, 2025

President Trump's deregulation

President Trump must have read Chapter Two:

- Voluntary Transactions create wealth by moving assets to higher-valued uses;

- Taxes, price controls, subsidies, and regualtion destroy wealth by preventing assets from moving to higher-valued uses.

[The deregulatory] plank of the Trump agenda has been eclipsed by drama over tariffs and the Republican tax bill, though it is economically as important and moving far faster. ...

Alaska has become the symbol of the effort, in part because, as ... Mr. Biden infamously directed more than 70 orders and actions at killing development in the state ...

Whereas it normally takes an agency years to repeal a few rules, the Energy Department had taken 47 deregulatory actions by mid-May, axing rules governing appliances, motors and heating and power equipment—saving consumers and business $11 billion. ...

Mr. Biden is estimated to have added more than $2 trillion in regulatory burdens to the economy over his four years. ... the Trump deregulation effort is going to be as central to any economic revival. Inside Alaska, and out.

I hope that Ms. Strassel writes about the President's deregulatory moves in other areas:

- Making it easier to develop nuclear power (link)

- Deregulating supersonic flight (we should be flying to London in two hours) (link)

- Deregulating Financial Technology (Fin Tech) that will increase innovation in banking services. (link)

BOTTOM LINE: Deregulation increases innovation which drives growth: real per capita income has doubled in the last 40 years.

Saturday, June 7, 2025

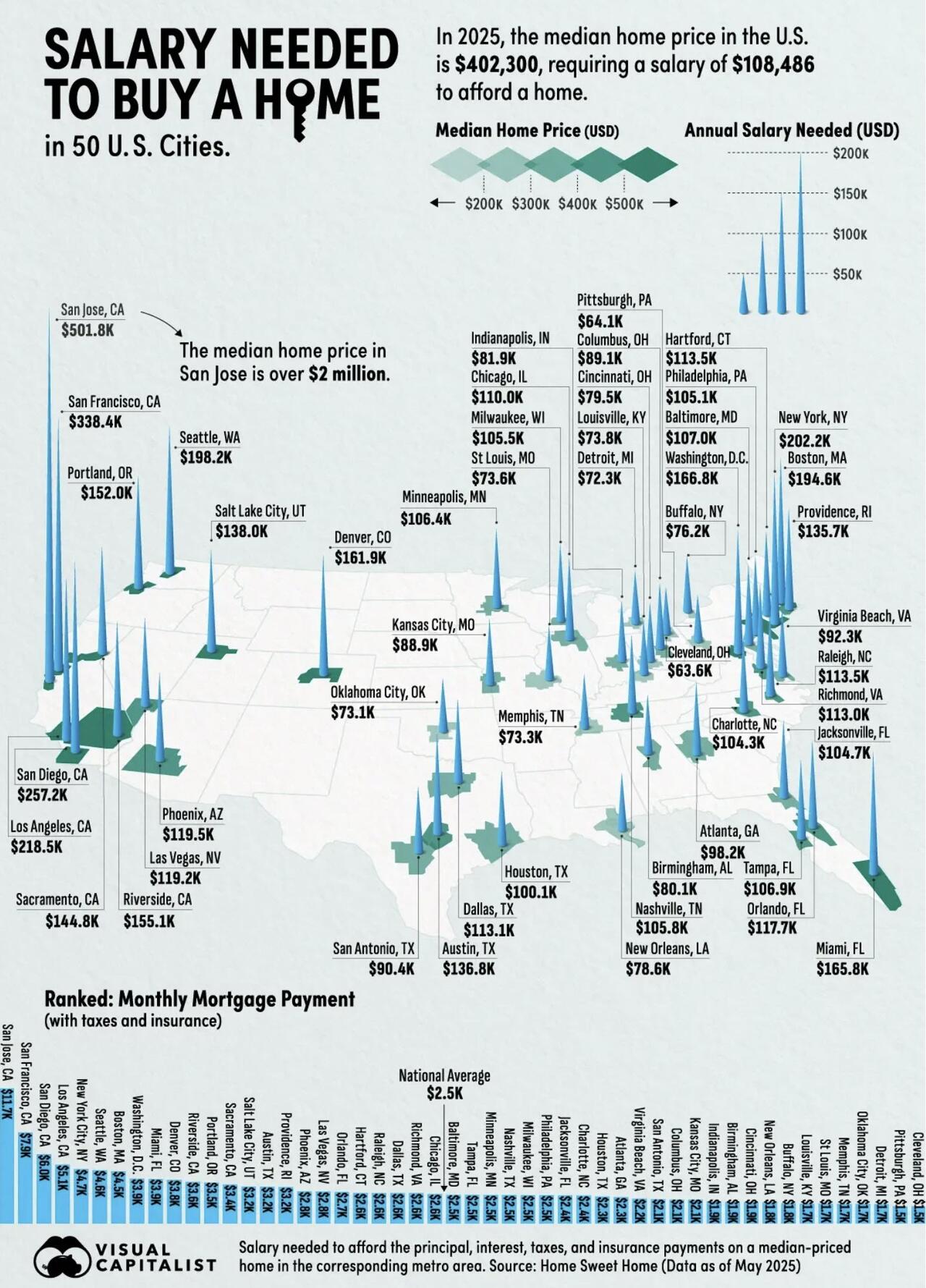

Why there is a housing shortage in California

...I spent two and a half years obtaining permits, navigating a labyrinthine zoning department and paying for not only architectural plans but geological surveys, sewer permits, street improvement clearances, an inventory of “California protected trees” performed by a state-licensed arborist and, most of all, fighting an unhinged neighbor who mobilized the entire block against me on the pretense that I had to build a sidewalk in front of my house even though the entire neighborhood is composed of craggy hillsides and there are no sidewalks anywhere.

In California, there are a hundred people who can say "no," and no one who can say "yes."

BOTTOM LINE: when you restrict supply, prices go up.

Thursday, June 5, 2025

Punishment increases → murder decreases

From the FreePress:

...Five years ago, ...police activity and staffing fell in big cities (where most of the crime is), as demoralized cops left the force. ...new policies—from chokehold bans to “no-chase” policies—further constrained police activity. ...

Unsurprisingly, murder soared.But now, following a political backlash, policing is back:

In those cities where activity has recovered—New York and Washington, D.C., for example—murder has fallen. In cities where activity remains low, like Seattle, murder is still high.However, police "have focused on bringing murder down, while sidelining other, less significant crimes. This helps explain surging public disorder, which has remained high even as homicide has dropped."

BOTTOM LINE: When criminals substitute away from high-punishment crimes, we say those crimes are "deterred," one of four justifications for punishment (Google):

- Retribution: This philosophy centers on the idea of "just deserts," meaning that offenders should be punished because they deserve it, and the punishment should be proportionate to the severity of the crime committed. It aims to achieve justice by making the offender suffer for the harm they've caused.

- Deterrence: Punishment can aim to prevent future crime by discouraging both the individual offender and others in society from committing similar acts.

- Specific deterrence: Intends to discourage the individual offender from repeating the crime due to the fear of further punishment.

- General deterrence: Seeks to make an example of the offender to dissuade others from engaging in criminal behavior.

- Incapacitation: This approach focuses on preventing future crime by removing the offender from society or limiting their ability to commit crimes. Examples include incarceration, house arrest, or even capital punishment.

- Rehabilitation: This goal aims to prevent future crime by altering the offender's behavior and addressing the underlying causes of their criminal conduct. Rehabilitation programs can include counseling, educational and vocational training, or treatment for substance use disorders.

Friday, May 30, 2025

What happens to natural gas prices when weather is mild?

WSJ:

U.S. natural gas futures were down for a third straight session as low weather-driven demand looks set to last into the first days of June while LNG feedgas flows eased and production edged up.

When demand decreases, prices fall.

Trade with China created US jobs

WSJ: The Real Story of the ‘China Shock’

The jobs harm was largely local and temporary, while overall jobs and consumer welfare increased. ...

There is growing evidence that, while Chinese imports did hammer certain regions, they didn’t cause large net job losses across the entire U.S. Recent research from the National Bureau of Economic Research finds that job losses locally were mostly balanced by job gains in other regions. Manufacturing-heavy areas in the Midwest and South saw employment declines, but services jobs sprouted in coastal and high-tech hubs like the West Coast and Northeast. Import competition shifted jobs rather than eliminated them. ...

While tariffs on Chinese goods might bring back a few factory jobs, they will raise prices for everyone and hurt U.S. businesses that rely on imports. Current attempts to turn back the clock by introducing tariffs are a costly remedy for a poorly understood ailment.

Subscribe to:

Posts (Atom)