If a firm makes a decision that increases costs or reduces quality, there are two immediate consequences: reduced sales as consumers turn to lower-priced, or higher-quality, alternatives; and a higher cost of capital, as lenders and investors turn to more profitable opportunities. Product market competition thus aligns the incentives of a firm with the goals of consumers, and capital market competition, with the goals of lenders and investors.

In contrast, if a government makes a bad decision, one that makes the state a less desirable place to work or do business, residents must wait until the next election, or move. This kind of pressure is weaker and delayed, as it is costly and takes time to start over in a new state. As a result, incentives for state government to better serve its residents are not as strong or immediate.

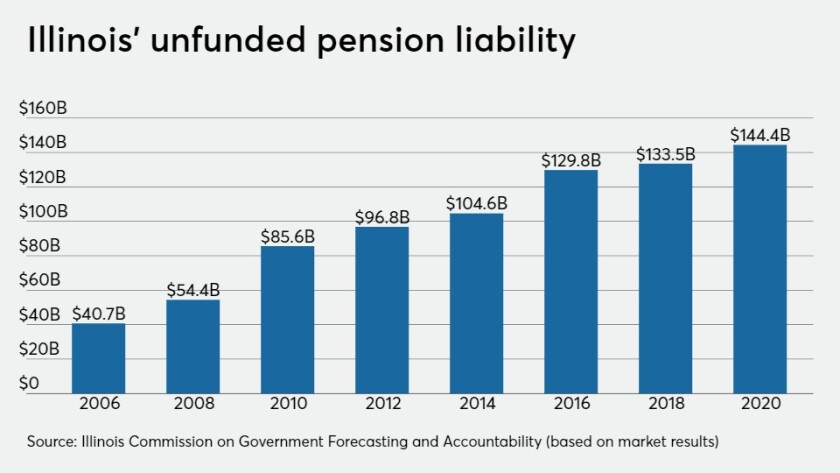

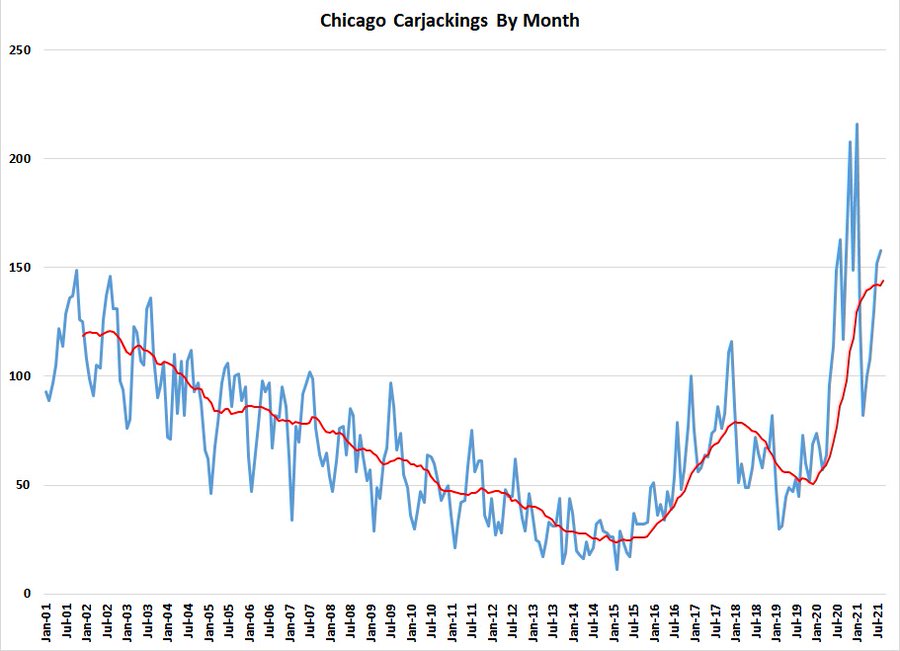

For example, Illinois has decided to under-fund state pensions for decades. Its taxpayers now face a huge future tax burden, and the prospect of reduced government services, like police protection. Current taxpayers are leaving because they can see a costly and crime-ridden future, and would-be taxpayers are locating in better-run states. This kind of competitive pressure is slowly building and should eventually lead to reform.

However, if Democrats raise the SALT (State and Local Tax) deduction for federal taxes, other states will end up paying for Illinois' mistakes, shielding Illinois from the full consequences of its bad decisions. This can only delay reform because governments, like children, do not learn from their mistakes, they learn from the consequences of their mistakes.